Investment Portfolio Management

Investment Portfolio Management

The Bread & Butter of Investing

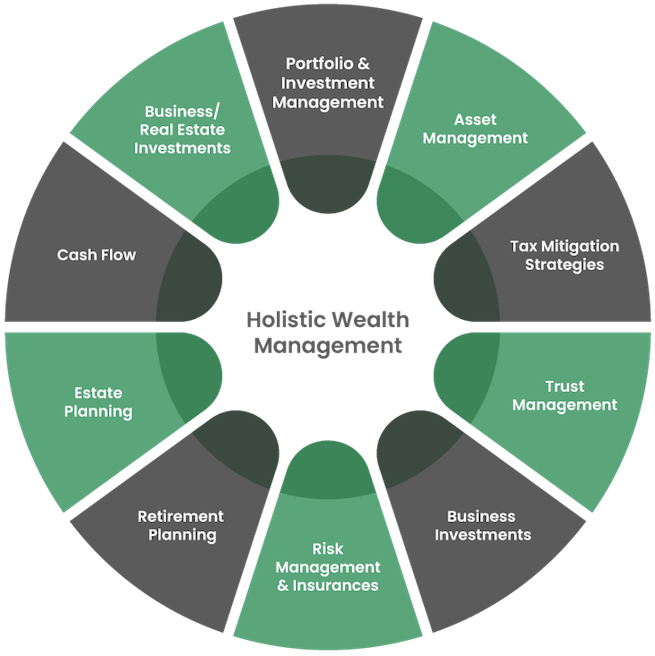

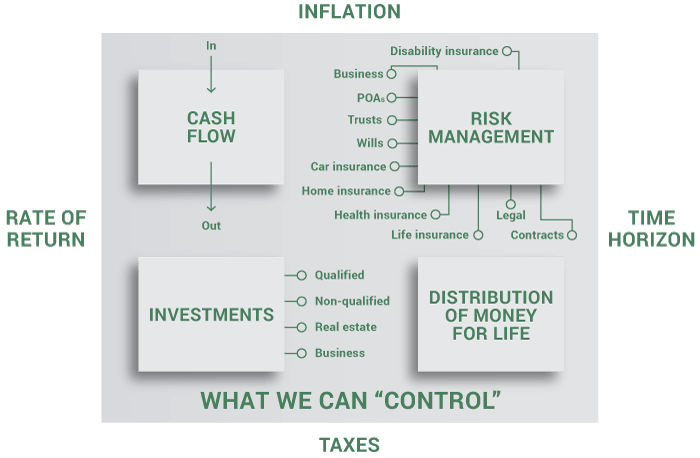

Investment Management at Heritage Investors takes your lifestyle into account. The modern work/life balance leaves you with precious little time. Between managing your career, your family, and your household, finding time to properly research and invest seems impossible. We understand.

That’s why we take the time to know you as a person, rather than just a client, so we can better understand your needs and financial goals. Whether you’re preparing for your children’s education or simply consolidating accounts, we are here to help you make your goals a reality.

At Heritage, we align the financial markets to your specific financial, tax, and risk management goals. Our team works tirelessly, researching quality investments we believe will yield the highest possible returns with the lowest possible costs. We then present our research to you in everyday terms, encouraging feedback and ensuring you feel confident in your individual plan.

Heritage Investors’ Style of Investment Portfolio Management

Investment Portfolio Management is for individuals who trust and understand that there is value in an expert handling this area. It’s for people who place a premium on time and personal care. Handling your own investments requires hours of research, constant market monitoring, and analysis that your busy life may not allow.

Additionally, you may understand investment technologies or possess the knowledge of how, and when, to course-correct with market changes, but if you’re like most people, you could struggle to detach your emotions from your investments.

That’s why we share the management philosophy of Berkshire Hathaway’s Warren Buffett who once said:

“Lethargy, bordering on sloth, remains the cornerstone of our investment style.”

Once the research has been conducted, build a strategy, and stick to the plan. Seldom are there successes in buying and selling based on a hunch or on knee-jerk reactions. Instead, Heritage utilizes proven research surrounding Target Band rebalancing.

What is Target Band Rebalancing?

Simply put, target-band rebalancing is a tool used to ensure your portfolio doesn’t become too heavy in one position or too light in another. The target-band monitors, purchases, and sells your stocks in real-time, and it does so with razor-sharp efficiency.

Essentially, a target-band analyzes the various positions and sets a strategic target so that when the position reaches that target, the target-band automatically sells the position and buys another.

Need more information? Learn the process we use to build and maintain your account.

PORTFOLIO MANAGEMENT PROCESS

Consdiering changing advisors? Take our assessment.

Ready to find out more?

One of our experienced advisors is ready to learn your needs and goals. Simply fill out the form below and we will call you for a pre-meeting to learn your needs and determine how we drive toward your financial goals.

Upon completion of the form, you will be contacted within one business day.

Worth checking out

- Gambling Sites Not On Gamstop

- Non Gamstop Casino Sites UK

- Meilleur Casino En Ligne

- Sports Betting Sites Not On Gamstop UK

- UK Casinos Not On Gamstop

- Online Casino

- Meilleur Casino En Ligne 2025

- Online Casinos

- Slots Not On Gamstop

- Online Casinos Nederland

- Casino Not On Gamstop

- Online Casinos Not On Gamstop

- Gambling Sites Not On Gamstop

- Casino Not On Gamstop

- Non Gamstop Casino UK

- Best Non Gamstop Casinos

- Non Gamstop Casino UK

- UK Casino Not On Gamstop

- UK Online Casinos Not On Gamstop

- UK Online Casinos Not On Gamstop

- Non Gamstop Casinos UK

- Uk Sports Betting Sites Not On Gamstop

- UK Casinos Not On Gamstop

- Migliori Casino Online Italia

- Crypto Casino

- Casino En Ligne Belgique

- Meilleur Casino En Ligne Belgique

- Meilleur Casino En Ligne Belgique

- Migliori Siti Non Aams

- Casino En Ligne Sans Vérification

- Meilleur Site De Paris Sportif International

- 씨벳

- Meilleur Casino En Ligne

- Casino Non Aams

- Migliori Casino Online

- Jeux Casino En Ligne

- Meilleurs Casino En Ligne

- Casino En Ligne Francais

- Crypto Casino

- Casino En Ligne Retrait Instantané