If you own a small business that has a single-owner our Basic Business Planning is designed for you. Your personal retirement goals are directly connected to the success of the business… both the day-to-day success and the sellable asset it will become.

As you can imagine, this process of gathering, assessing, modifying, and monitoring the numbers can be an in-depth and complicated process. This process becomes exponentially more complicated having both personal and business growth planning working in tandem. It takes a special team with unparalleled knowledge and experience to accomplish this monumental task. The team at Heritage Investors has been trained as CERTIFIED FINANCIAL PLANNERS™, Certified Exit Planning Advisors, and Certified Value Growth Advisors™. This expertise along with years of experience (as well as living the life of entrepreneurs ourselves) makes us unique, not just here in Knoxville but also around the country.

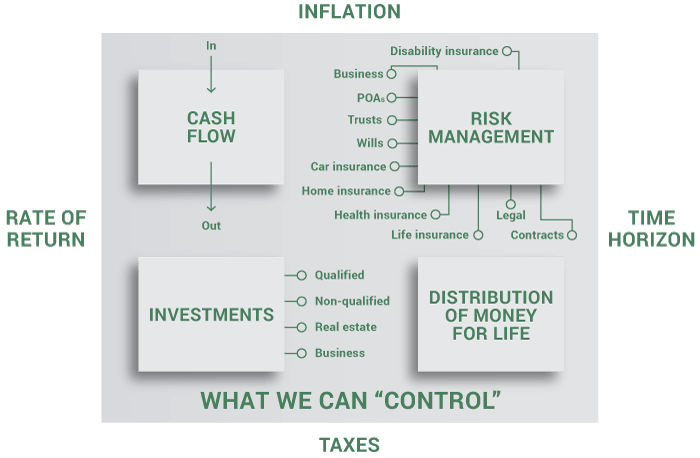

As part of this highly specialized process of financial planning, we might work through and implement some or all the following areas:

Growing Business Value |

Tax Mitigation |

Power of Attorney |

Health Insurance |

Life Insurance |

Auto/Home Insurance |

Wills/Trusts |

Debt Management |

Real Estate Strategies |

Qualified Investments |

Non-qualified Investments |

Quantification/KPIs |

Retirement Accounts |

Learn more about how we tackle each of these areas:

Next Steps…

We can help you develop a strategy with the goal of helping you preserve the lifestyle you are accustomed to throughout retirement. Simply fill out the form below or call 865-690-1155 and we will schedule a no-pressure, no-obligation meeting to determine how we drive toward your financial goals and life dreams.

Worth checking out

- Gambling Sites Not On Gamstop

- Non Gamstop Casino Sites UK

- Meilleur Casino En Ligne

- Sports Betting Sites Not On Gamstop UK

- UK Casinos Not On Gamstop

- Online Casino

- Meilleur Casino En Ligne 2025

- Online Casinos

- Slots Not On Gamstop

- Online Casinos Nederland

- Casino Not On Gamstop

- Online Casinos Not On Gamstop

- Gambling Sites Not On Gamstop

- Casino Not On Gamstop

- Non Gamstop Casino UK

- Best Non Gamstop Casinos

- Non Gamstop Casino UK

- UK Casino Not On Gamstop

- UK Online Casinos Not On Gamstop

- UK Online Casinos Not On Gamstop

- Non Gamstop Casinos UK

- Uk Sports Betting Sites Not On Gamstop

- UK Casinos Not On Gamstop

- Migliori Casino Online Italia

- Crypto Casino

- Casino En Ligne Belgique

- Meilleur Casino En Ligne Belgique

- Meilleur Casino En Ligne Belgique

- Migliori Siti Non Aams

- Casino En Ligne Sans Vérification

- Meilleur Site De Paris Sportif International

- 씨벳

- Meilleur Casino En Ligne

- Casino Non Aams

- Migliori Casino Online

- Jeux Casino En Ligne

- Meilleurs Casino En Ligne

- Casino En Ligne Francais

- Crypto Casino

- Casino En Ligne Retrait Instantané